Financial

In finance, information timing is critical. VeriLens enables banks, investment firms, and fintechs to track media sentiment, market-moving news, and competitor activities. Our AI-powered platform supports reputation management, regulatory alerting, and real-time risk intelligence to keep you ahead in today’s dynamic financial landscape.

How the Solution Solves It

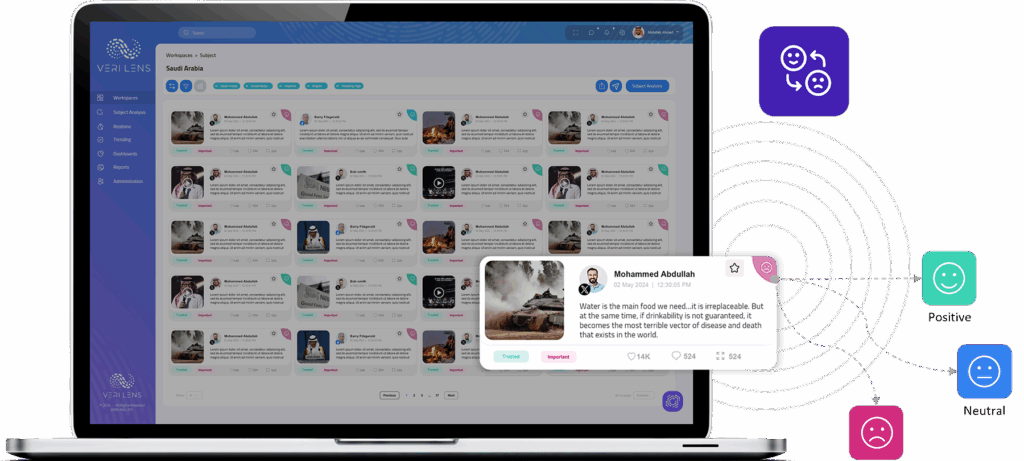

Monitors real-time public sentiment about banks, fintech apps, trading platforms, and financial services—capturing issues before formal complaints are made.

Detects early signs of negative news or social media trends (e.g., bank outages, fraud allegations, customer service failures) that may damage a brand or spark panic.

Unifies data from multiple sources—credit cards, investment accounts, mortgages, loans—into a single dashboard for feedback analysis.

Tracks discussions, reactions, and emotional sentiment related to stock market movements, IPOs, and financial policy changes.

Flags spikes in keywords like “hacked”, “phishing”, “fake investment”, or “account frozen”, helping risk and fraud teams respond faster.

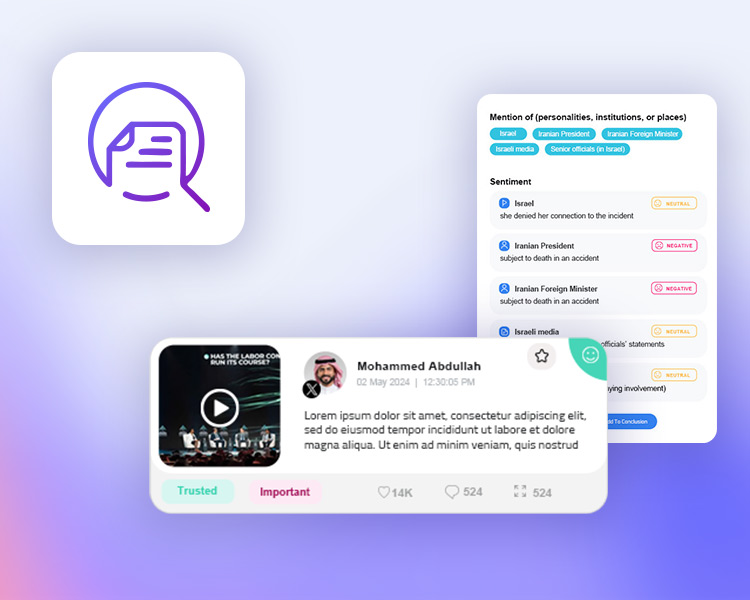

Analyzes reactions to announcements from entities like SAMA, CMA, Tadawul, or global markets to assess public sentiment and understanding.

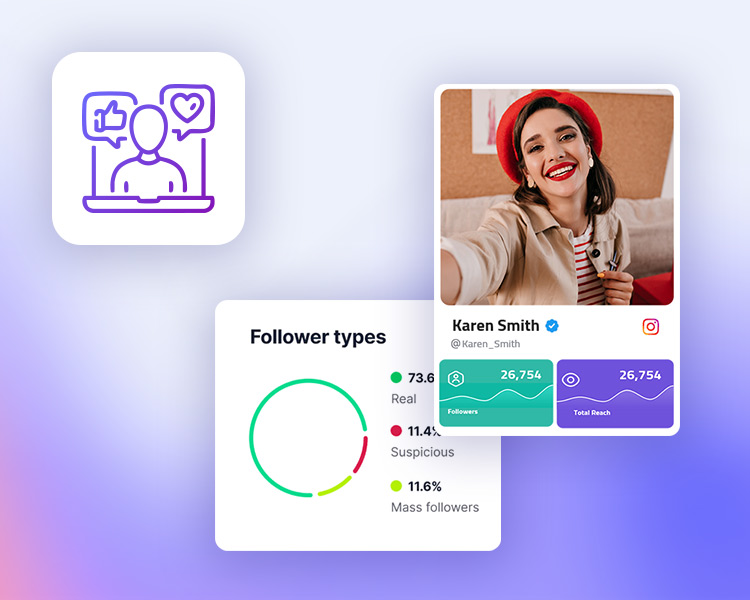

Gathers reviews and discussions about digital banking apps, wallets, and payment gateways across platforms like X, TikTok, Facebook, and etc…

Monitors language used by investors, influencers, and financial communities to understand confidence levels during market events or crises.

Captures feedback and scrutiny on financial institutions’ performance in areas like sustainability, compliance, transparency, or diversity.

Helps regulators and financial ombudsmen spot patterns of abuse, unfair charges, or deceptive financial practices based on unstructured social feedback.

VERILENSInsights

Markets move on information and perception.

In the financial sector, trust and reputation are as valuable as assets. A single headline, tweet, or influencer statement can shift investor confidence, trigger withdrawals, or spark regulatory inquiry. Media intelligence helps financial institutions anticipate risk, monitor sentiment, and maintain brand credibility in volatile environments.

71% of investors say media sentiment influences their perception of a financial institution’s stability.

65% of financial crises could have been mitigated with earlier risk perception analysis.

80% of fintech users say online reputation and reviews directly impact their adoption of financial services.